Product Design Leadership:

Origin Markets

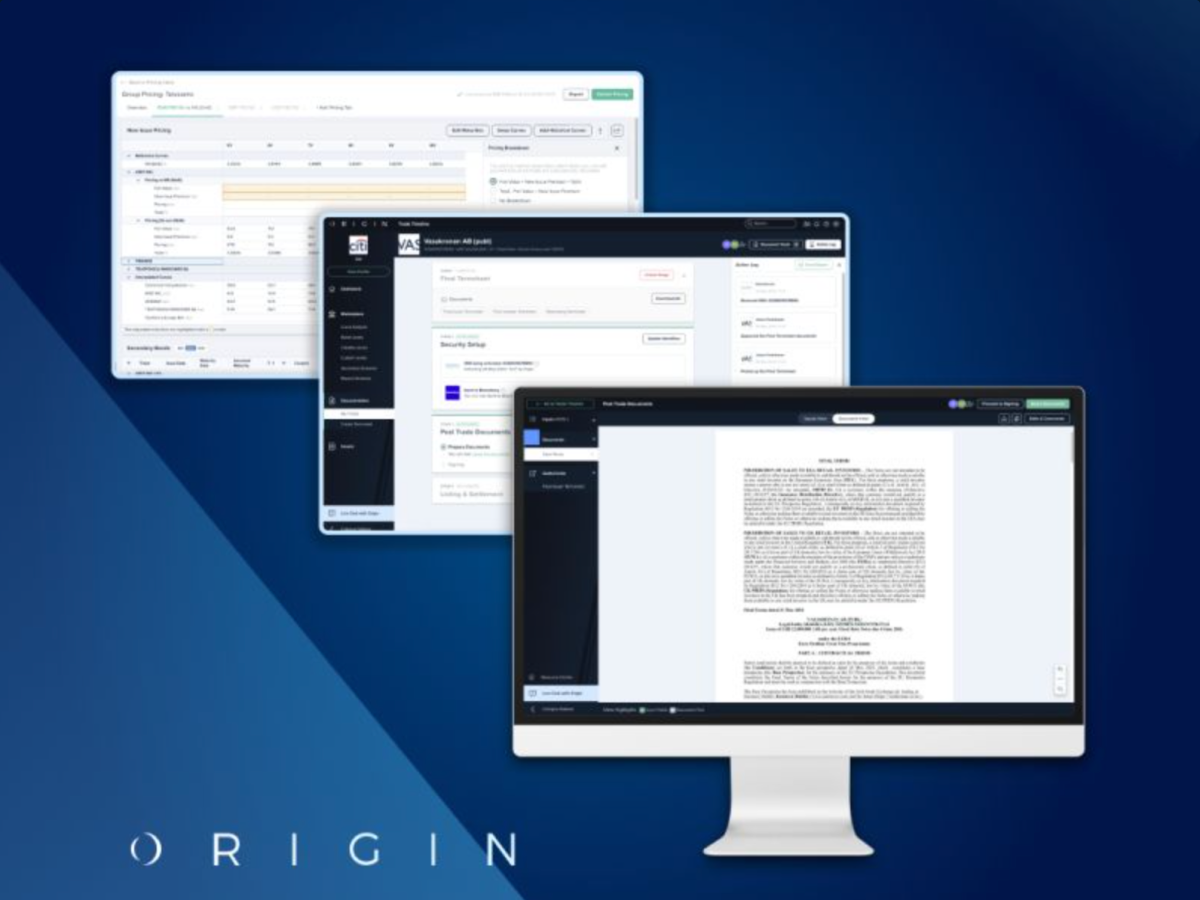

Aligning fintech products with business & customer needs for Origin's fully digital, front-to-back issuance platform that brings simplicity to the global debt capital markets

As the first in-house designer at Origin, I was responsible for establishing the company’s design foundation and processes. I created and implemented a comprehensive design system from the ground up, ensuring accessibility, consistency and scalability across the platform. Additionally, I introduced a structured design process to bring user experience and interface design in-house, streamlining collaboration with product and engineering while helping them align more closely with business goals.

My work focused on simplifying the debt issuance lifecycle — from pricing to settlement — by creating intuitive interfaces that met the needs of over 100 borrowers and 20 major investment banks. By understanding complex financial products like bonds, structured notes, and money market instruments, I ensured the platform served nearly 700 professionals across 70 cities effectively.

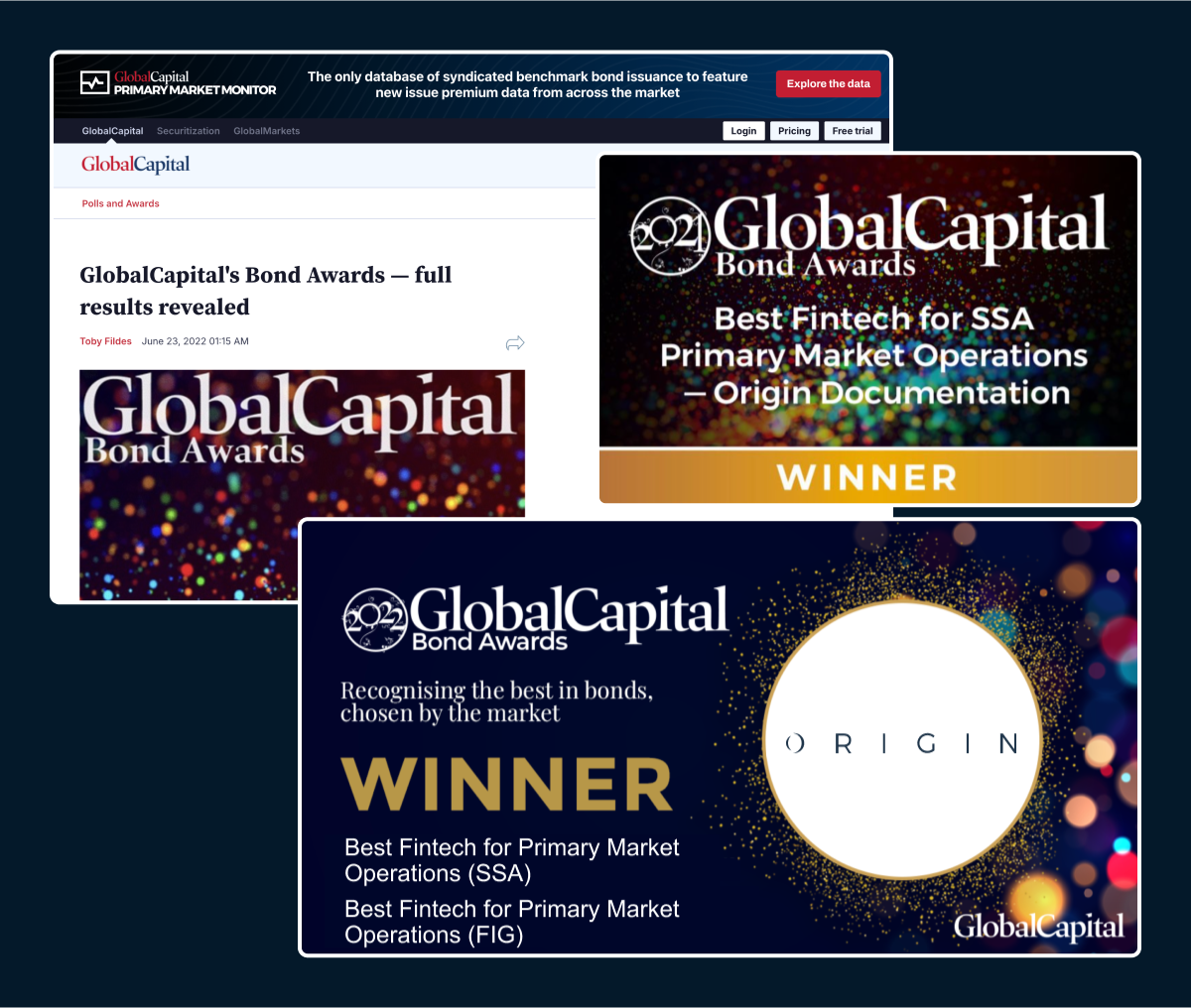

These efforts were instrumental in Origin being voted the best fintech in the field for three consecutive years, solidifying its reputation as a leader in the international debt markets.

Origin Markets

Tools

Skills

Product Design Leadership · UX / UI Design · Accessibility · Prototyping · Cross-functional Collaboration · Research & Testing

mission & purpose

Origin’s vision is to be the data and communication layer at the centre of the global debt capital markets. Our team’s biggest challenge was bringing simplicity to an industry that still heavily relies on manual processes and outdated software.

To overcome this challenge, we focus on designing and building exceptional products. While our products are crucial to our business, we understand that success depends not just on building, but on thoughtful design from the start.

Design forms the foundation of everything we do — it's the cornerstone of our business. Our design process serves as the central point where all business functions unite and collaborate.

So, how do we approach this?

design & implementation process

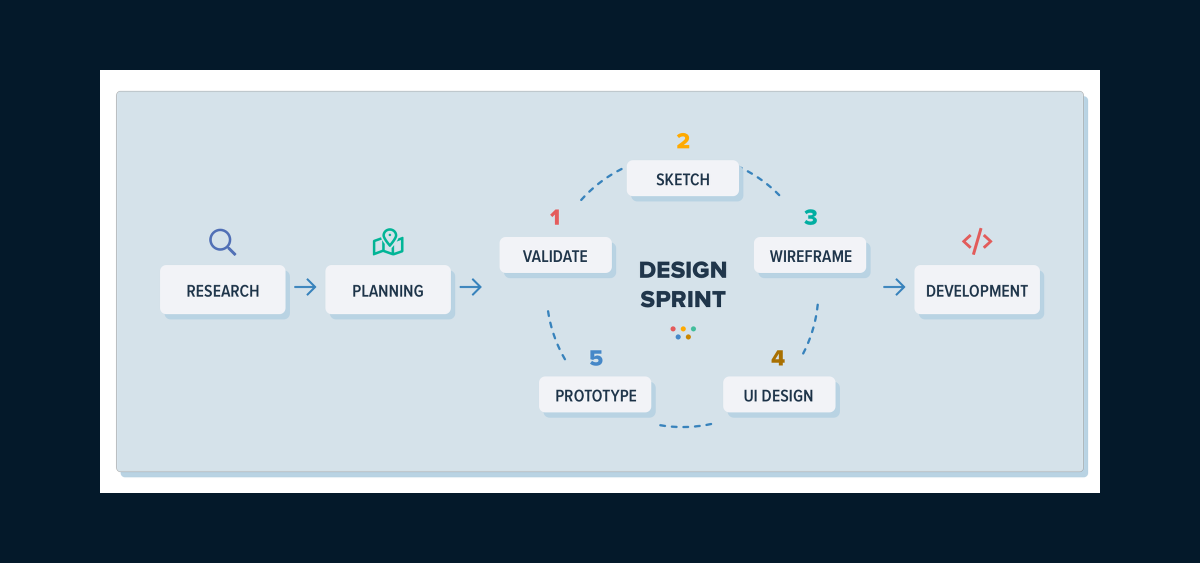

from initial concept …

Our product development starts with understanding our users. We collaborated closely with early customers to identify real pain points and create solutions that truly work for them. This hands-on approach gave us deep insights into their daily workflows and challenges.

Design thinking is at our core - Our diverse team brought together expertise in capital markets, product, tech, and design. We ran focused workshops to align everyone's perspectives and accelerate ideation.

We followed a lean UX process - quick sketches, rapid prototyping, and constant user feedback helped us validate ideas early. This iterative approach let us test multiple design directions efficiently before committing resources.

Before building anything, we validated our designs through user testing with interactive prototypes. Only solutions that demonstrate clear value to our customers move forward to development.

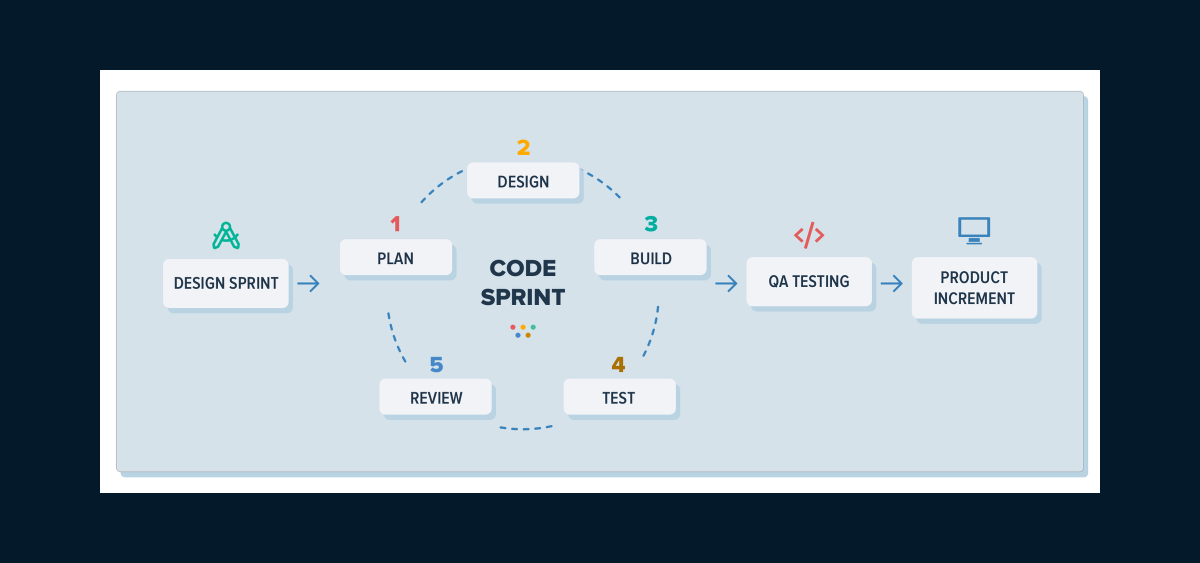

… to implementation

After finalising the designs, our development team divided the work into small, manageable pieces. This allowed us to deliver value to our customers quickly and efficiently through our iterative approach.

Quality is paramount in our process - Each piece of code went through thorough peer review and a comprehensive week of testing by our QA team to ensure reliability.

We continuously collected customer feedback as we released new features - Our design process remained flexible - we were always ready to refine our approach if we saw an opportunity to create a simpler, more effective solution for our users.

soft launch & continuous refinement

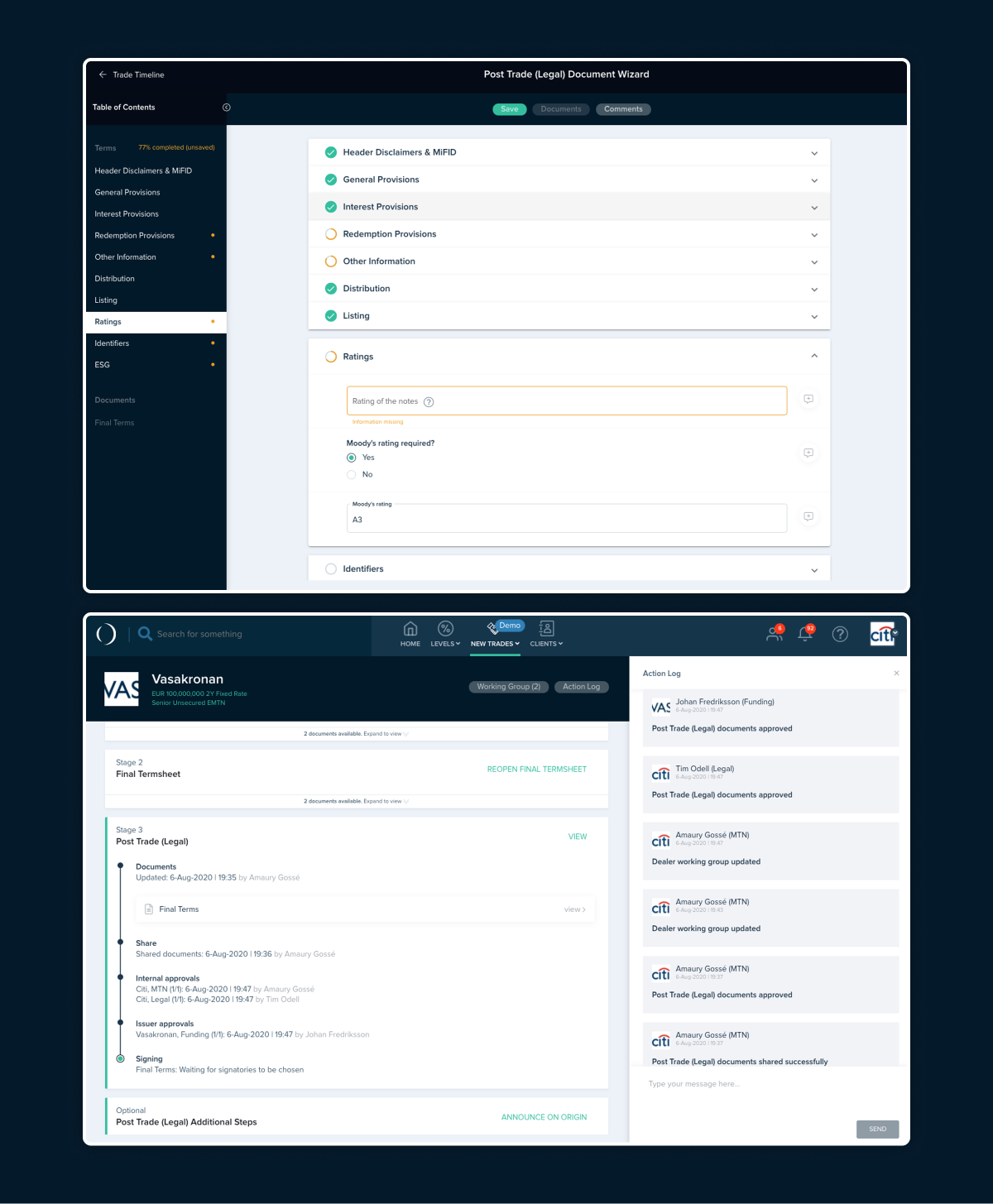

In 2020, Euromoney Magazine profiled our venture into the next stage of the bond issuance lifecycle as we began developing this feature. Last year, we successfully demonstrated the product's effectiveness through the first fully digitally issued bond—a groundbreaking and award-winning transaction between Vasakronan and Citi.

Since then, we've been diligently working, executing four more transactions across Europe and Asia while continuously refining, updating, and enhancing the feature.

Recently, we announced the penultimate step: a "soft launch" of Origin Documentation to a select group of 11 Dealers and 16 Issuers. This precedes a planned wider release to all our customers.

what is a soft launch?

A soft launch is a concept widely used in tech. Unlike a "proof of concept" or a "pilot", it involves a full release of the product in a live, real-world environment, rather than in a sandbox or a highly choreographed test. The release is initially staggered to a smaller group of customers before a full release later.

This approach allowed us to observe how our customers use—and potentially break—the product in real-life situations, providing more insightful feedback than a typical pilot. By the time we fully released the product, we were confident it had been stress-tested in genuine scenarios.

continuously refining

We were never satisfied with the first version of a product, and we rarely settled for the second or third iterations either.

How has our Documentation product evolved over the past year? The five live transactions we've completed in the last 12 months have provided us with invaluable feedback. These improvements fall into two main categories:

1

Architecture: We've revamped the back-end architecture of our Termsheet Generator, making it significantly more flexible. This enhancement allows us to support a wider variety of transactions and additional functionality.

2

User Experience: Following our Marketplace redesign earlier in 2020, we've completely overhauled the user experience and workflow of our Documentation tool. Creating a workflow tool that seamlessly connects multiple users across various teams and institutions is challenging. It's even more difficult to develop a product that's both enjoyable to use and habit-forming. Our commitment to continuous improvement and rigorous customer testing has enabled us to refine the UX, making it sleeker, faster, and more efficient.

casestudy

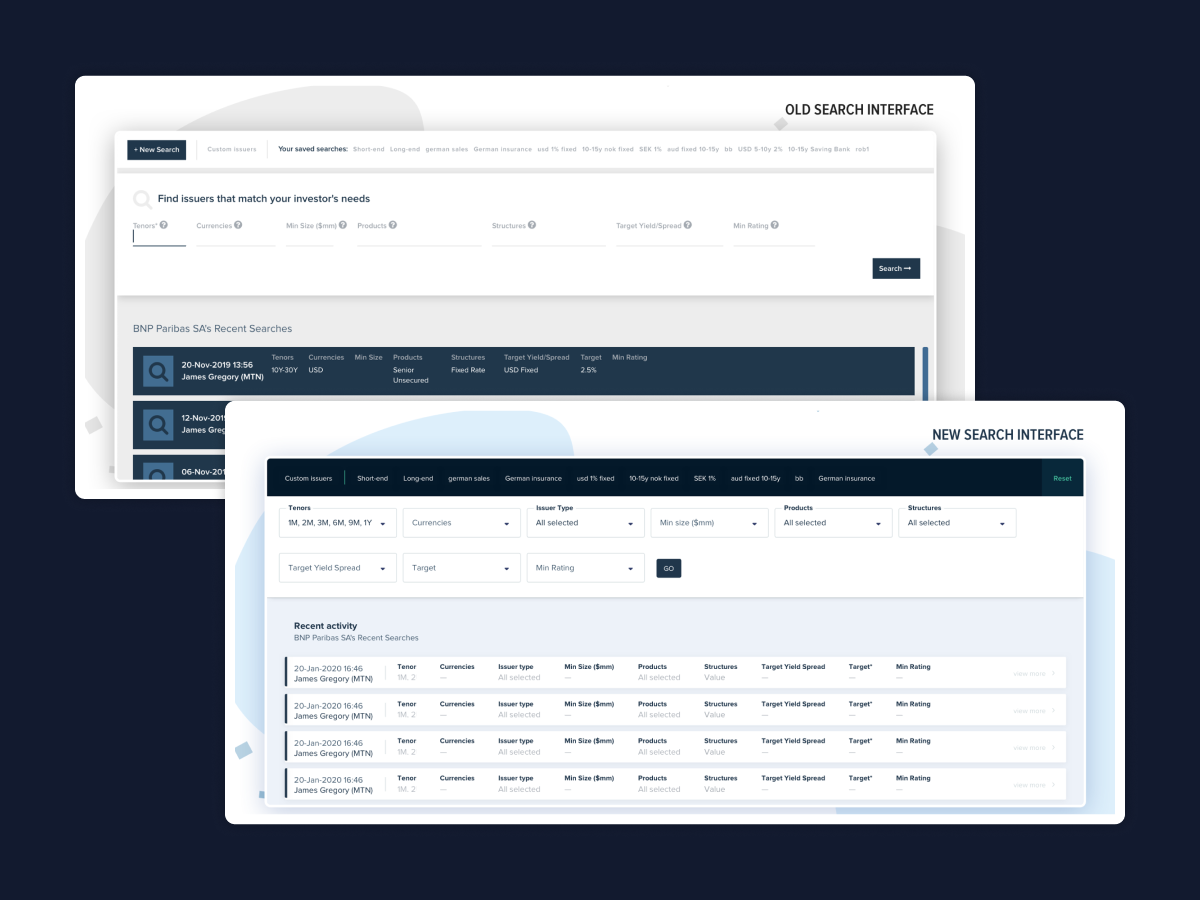

Product revamp of Origin's Funding Matrix

The Funding Matrix is the most used feature in Origin's Marketplace product. It allows dealers across DCM, Syndicate, and Sales to quickly search our issuer database, finding those seeking funding who match specific criteria such as yield, spread, and ratings.

building on our customer footprint

Digitising highly manual workflows is challenging. However, we were fortunate to have access to a broad, diverse, and extensive pool of customers from whom we can gather valuable feedback.

Our Marketplace, serving over 20 Dealers and nearly 90 Issuers globally, gave us deep insights into market operations and user behaviour. We shared all new features with our customers immediately to gather their feedback. Throughout our platform's two-year revamp, we carefully studied and incorporated these insights.

learnings

Technology alone doesn't guarantee a product's success. The key challenge is adoption—ensuring users integrate the tool into their daily routines. While our approach has been deliberate and measured, we believe that prioritising client relationships from the start maximises our chances of long-term success.

We're deeply grateful to our clients who have invested their time, energy, and insights with us over the years.